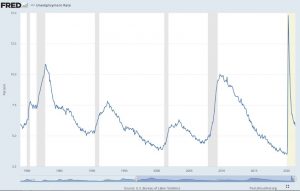

The recovery in US jobs has paused during the past couple months. At April month-end, 8.2 million fewer people were working than the beginning of 2020. As one might expect, there is disagreement about the cause of this pause. One camp generally argues the added unemployment benefits which can allow claimants to receive the equivalent of a $15 an hour full-time job explains the reluctance to seek work. Others suggest the fear of infection and children learning from home accounts for much of the weakness. Regardless of the reason for unfilled jobs, fewer employees along with other supply-chain issues continue to drive supply and demand imbalance.

These imbalances are beginning to result in higher price inflation as a number of companies are raising prices in response to higher expenses. As Warren Buffett mentioned in the recent Berkshire Hathaway (a diversified conglomerate across many industries) meeting, “We’re raising prices, people are raising prices to us, and it’s being accepted. It’s an economy really that’s red hot.”

So far, long-term inflation is not a foregone conclusion. The current consumer price index is +2.6% year-over-year. Since the early 1980’s, inflation has increased to 2.6% and beyond 16 times. Yet it has eventually fallen back below that level. Additionally, bond markets are forecasting inflation of +2.2% between 2026 and 2031. Many of the factors that could lead to higher prices may reverse themselves and reduce the inflationary threat. However, it does seem that there is more concern in the markets than in the recent past.

In a recent Wall Street Journal article, James Mackintosh laid out several reasons why inflation may continue to gradually increase over the next few years. These reasons include:

- Central banks, led by the Federal Reserve, are now less concerned about inflation.

- Politics has shifted to spend even more now, pay even less later.

- Globalization is out of fashion.

- Demographics worsen the situation.

- Empowered labor puts upward pressure on wages and prices.

Depending on one’s point of view, while the result may be higher inflation, the ends may justify the means. For instance, the Federal Reserve has emphasized a goal of full employment including marginalized workers. Trying to create an environment that allows for as many jobs as possible may result in letting the economy run hotter than in the past, leading to ongoing supply/demand imbalances and thus higher inflation.

Regardless, we believe it is important for monetary and fiscal policy to be proactive and contain prices. Inflation is corrosive not only to spending power (especially to lower income citizens), but also to financial asset prices.

Including dividends, the S&P 500 has risen about 13% so far in 2021. Although this is more than the average full year return for stocks for the past 15 years, it actually parallels the increase in expected 2021 corporate profits since the beginning of the year. The fact that forecasts are still rising indicates that analysts and investors’ expectations have been catching up to the actual improvement in the economy. If this continues, we would not be surprised if equities rise further in the short-run.

At the same time, stock prices (compared to earnings) are at high levels versus their historical average. Although valuations are a notoriously unreliable method in deciding when to reduce one’s exposure to stocks, it does pay to increase caution in the midst of a frothy market. We can’t predict market turmoil; we can and do try to continuously prepare for it.